What is Debt to Income Ratio?

Understanding the debt to income ratio is essential for financing aspects when you are looking to purchase your first home. Many times we focus on keeping a quality credit score and overlook the importance of understanding and preparing a debt to income ratio. I know the first time I started the home buying process. I had never heard the term. It wasn’t until I sat in the finance office of a Wells Fargo Bank that I learned the importance of debt to income ratio would play in my financing.

The debt to income ratio is a reasonably simple division problem. You divide your monthly payments by your monthly GROSS income. Notice my emphasis on Gross income as opposed to net income. Monthly gross income is the total income you bring home ( just remember pre-taxes).

You will need to check with your local financing specialist to confirm what DTI percentage you will need. But a common goal to shoot for is under 38%. Here is a quick example. If my monthly gross income is $5,000 and all of my personal monthly debt payments are $750.00 a month, my debt to income ratio (DTI) would be 15%.

Remember, it is the total amount of your monthly debt minimum payments. An excellent example of this payment would be your credit card or car payment. Again notice above how I have emphasized minimum, many of us will make larger monthly payments on bills to pay them off quicker. That additional money is not counted in your DTI. You should check with your mortgage broker first to see what your DTI needs to be to attain your loan successfully.

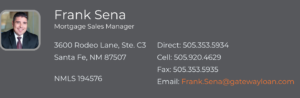

sponsored by:

About Jerome Leyba:

Jerome is a Santa Fe local and associate realtor for Leyba Real Estate.